Written by Christina Kevorkov

For a high school senior or a newly-admitted college student, the FAFSA or Free Application for Student Aid is a government form that determines someone’s eligibility for receiving financial aid to usually cover the annual fees of baccalaureate/undergraduate degree.

While their federal website confidently states that the form should take no more than an hour to complete, for many students this form is far from a simple, short and sweet 20 minute to-do list task. It requires so much attention to detail and immaculate precision that forces students to complete an irrelevant form about things they probably don’t know or really care about. But, they have to do it: their dreams depend on it.

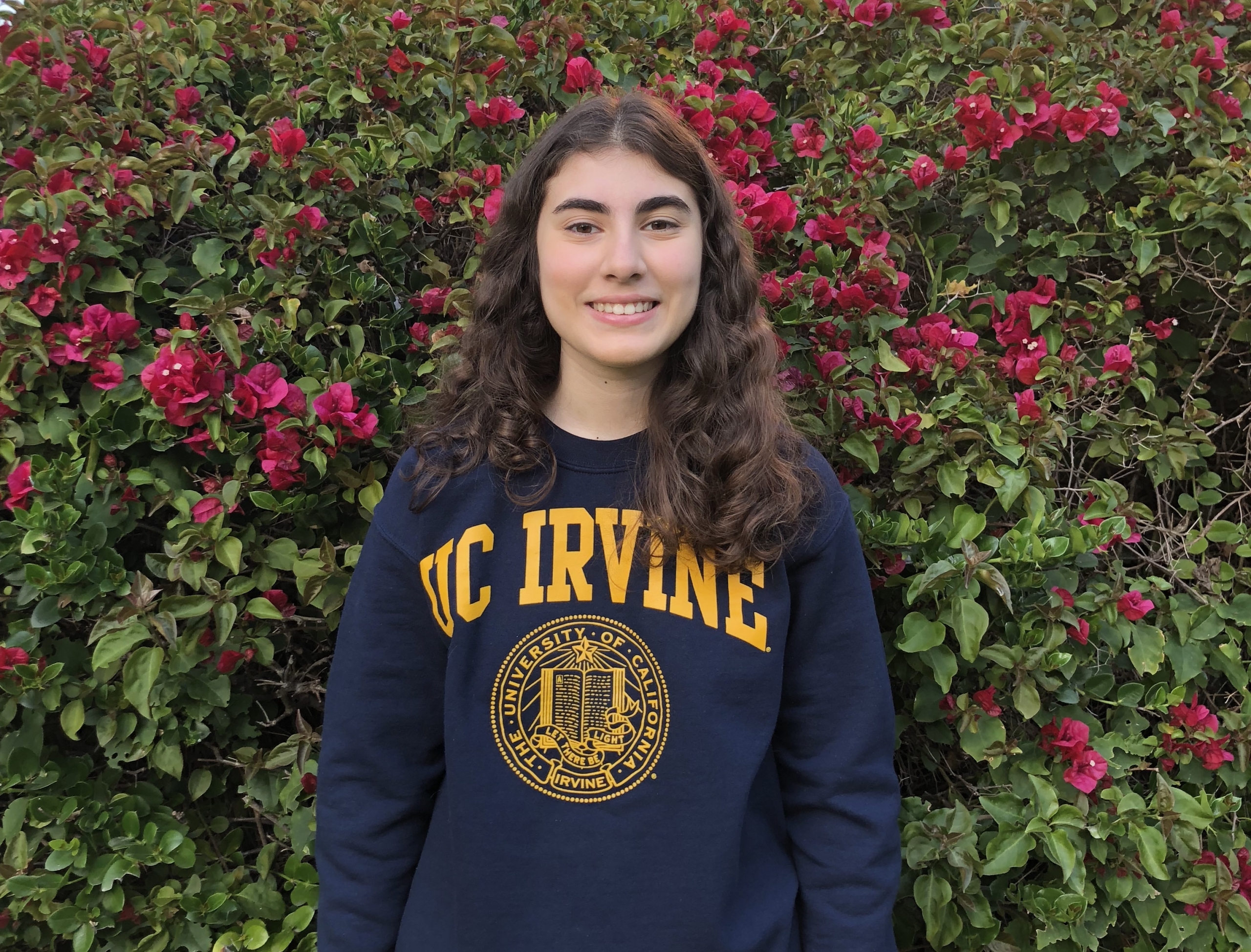

For college students like Nicole Guerrero-Andia, a first year Criminology, Law, and Society major at the University of California, Irvine applying for the FAFSA/DREAM Act is challenging because it reminds her about the stresses of being an immigrant in the United States, the uncertainty of being the first to pursue college in her family, and the fear of being unable to economically support herself.

“I was so confused because I could not apply for the FAFSA. I learned that I qualified for the DREAM Act. I was lost. It was scary and tiring. I was so stressed. I didn’t know what to do before the deadline,” Guerrero-Andia confides.

This complex financial form is especially degrading and confusing because you get only one chance to do it. Although errors on the FAFSA can sometimes be adjusted, the chances remain that if students fail to answer these questions correctly, it may significantly reduce their chance of going to college.

It seems that the scariest possibility is finding out that you made a mistake that permanently impacts your chance of receiving aid for college. Specifically, students of low-income families suffer the most with this harsh reality. And this is because the FAFSA figuratively screams that their educational ambitions and dreams are limited due to their family’s inability to afford college. Although they advertise loans to pay off the growing tuition, these loans gain interest fees that make it even harder to keep up with coexisting financial challenges.

Guerrero-Andia states, “One mistake can make students work full-time regardless of their family’s low income. It may even cause students to drop out.”

In her struggles of completing the form, Guerrero-Andia was inevitably forced to take out a loan to pay the remaining fees of her education. By taking out this loan, she was pressured to balance school with work, which can be an extremely consuming experience for a first-year, first-generation student who is still trying to adjust to college academics. She states, “I have to do loans. I work and go to school full-time. I work 25-30 hours to pay off $4,000 dollars that go up with interest. If I didn’t get financial aid, I wouldn’t go to UCI.”

For most people, the pursuit of an education is a valuable, humbling, and necessary way to survive the chaos of the problematic world we live in. Our academic and personal dreams in the midst of all these worldly conflicts are fundamentally the most significant thing to look forward to. And I believe that to encourage educational “dream chasing” we must remove the affordability factor in pursuing our college goals.

Guerrero-Andia agrees that as students fill out these financial forms, the process can be overwhelming and unpredictable for those who come from lower socioeconomic backgrounds.

“Whatever your socioeconomic status is, it affects your ability to attend college. It traps them in a box. Affording college is a game. Nobody knows how to play it or win it. Especially when it comes to people of color and lower socioeconomic status.”

And it’s easy to forget that this form is intended for graduating 17-year-olds in high school, who don’t worry too much about the cost of their education simply because to consider dream careers and college campuses is prioritized.

On the surface level, it seems that the federal government is promoting all students to apply for college financial aid regardless of their family’s economic conditions; however, there is a hidden aspect in how answering these mundane questions may correlate to increased levels of stress, anxiety, and most importantly, the awful feeling of unbelonging.

While the FAFSA form continues to place an “affordability” factor in the wording of their questions, hard-working students such as Nicole Guerrero-Andia continue to break all stereotypes because they want to achieve their dreams, and no financial form will ever impact their ability to succeed.

Christina Kevorkov is a first-year English major. She is a writer and marketing manager for InSight Magazine. She can be reached at [email protected].

Its great as your other posts : D, appreciate it for putting up. “Before borrowing money from a friend it’s best to decide which you need most.” by Joe Moore.

Like!! Thank you for publishing this awesome article.